Humans and Customer Engagement

The digital conversation is still very much a dominant one in financial services. Even as attention turns to market tumults and recession-proofing, the ability to serve clients in a digital world remains a key imperative for the country’s institutions. That’s likely because executives by this point realize that nailing the digital experience is foundational to their future, including in their capacity to weather downturns and difficult times. However, these efforts require nuance. It’s not just about going digital — it’s about going digital in the right ways and at the right times. And that means understanding when self-service isn’t enough, and when an actual person is necessary.

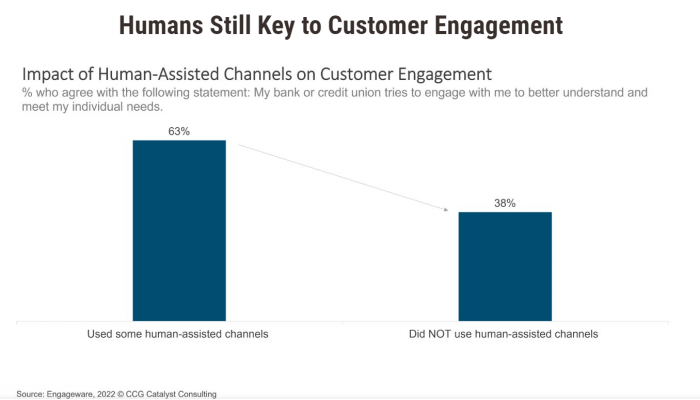

A good way to think about it is like this: While digital channels are critical to the future success of the bank, human interaction, at least for now, is critical to the success of those channels. This is illustrated in a recent survey by Engageware, which found that having some level of human interaction drives greater customer engagement and satisfaction. Specifically, 63% of respondents who reported leveraging some human-assisted channels when interacting with their bank said they felt their institution tries to engage with them to better understand their needs, compared with just 38% of those who said they did not use any human-assisted channels. This suggests that focusing on digital without the human element ultimately risks subpar experiences overall.

As the digital experience matures, it is likely that the need for human intervention will decrease, or even subside entirely. But, in the meantime, institutions should be focusing on how to create hybrid experiences that make sense for their customers. Figuring out when customers want to go it alone, when they are happy for a digital assist, and when they want to talk to a person should be a key component of developing any digital strategy. Customers are complex, and your delivery should reflect that — while also appearing seamless and simple. If that sounds hard to do, it’s because it is. But the way customers expect to interact with services, inside and outside of banking, is changing. They want things to be easy. And it won’t be long before their tolerance wanes. As such, putting in the effort to get this right now is likely more than worthwhile.

Reference: CCG Insights